FUELLING TOMORROW

CONCEPT AND IDEAS

Networking & Connecting, Think Tank to Viability...

Welcome to TYCHE – A Concept for the Future of Property Purchasing and Obtainable Investments

Concept Business Idea - Fractional Share Scheme

Tyche (tee-che or niche)

Tyche: Unlock Fortune, Share the Wealth: Fractional Share Scheme

A Futuristic Approach to Property Investment

In today’s economy, traditional homeownership is increasingly out of reach.

Rising mortgage rates are placing homeowners under financial strain, and globally, the property market is facing a complex and growing dilemma as the ownership gap for the general population becomes untenable.

Enter Tyche — a new approach to property investment built around two core components:

1️⃣ The Business Model – A structured framework that enables 25% housing fractional share parcels as equity buy-ins for co-investment opportunities.

2️⃣ The User Application – A digital platform that allows individuals to participate in property ownership with a minimal 25% financial commitment, anonymously.

Our mission is to bridge the gap — helping people invest in property, retain homeownership, and build wealth and equity in a more modernised, accessible, and sustainable way.

Whether you’re a homeowner seeking financial relief or a small-scale investor looking for a smarter, lower-barrier entry into real estate, Tyche offers a win–win solution.

By fractionalising property ownership — similar to business shareholding or time-share structures, with optional quarterly fractional buy-ins — Tyche makes equity more accessible, risk more manageable, and homeownership possible again.

This isn’t just theory — it’s a glimpse into the future of real estate. 🏡

SHARES PARCELS - IN PROPERTY

WHAT is Tyche ?

THE Future of Property OWNERSHIP

The property market is broken. Families struggle to buy homes, mortgage stress is relentless, young people rent with strangers just to save a deposit—only to face brutal moves and rising costs. Investors are priced out, and too many elderly Australians are displaced from the homes they worked lifetimes to own, often pushed into "resort-style living" schemes that force them to relinquish hard-earned equity. Let that sink in: a system that should provide security instead creates hardship and uncertainty.

Tyche is the solution. Named after the ancient Greek goddess of fortune, luck, prosperity, and guiding chance (pronounced "tee-che" — a soft, welcoming take on the classic name), we stand for a fairer future for humanity and equitable access to property.

Tyche offers a smarter, more humane way to invest in real estate through fractional ownership. Homeowners can sell a portion (such as 25%) of their property's equity for immediate financial relief—while staying in their beloved home. Investors gain entry into the market with lower capital, shared risks, and potential for long-term equity growth—without the burdens of full ownership.

Key Benefits

-

Homeowners keep their homes, avoid foreclosure or forced sales, and regain financial stability.

-

Investors access real estate at a fraction of the cost, with proportionate equity and no landlord hassles.

-

A true win-win that challenges the outdated, one-size-fits-all property system and puts people first.

It's time to rethink property ownership. With Tyche, fortune favors the aligned—and prosperity is shared.

FACTUAL PROBLEMS

The Traditional Property Market Is Failing Everyday People

Homeownership is becoming impossible, foreclosures are rising, and the wealth gap keeps widening as real estate becomes a game only the elite can play.

💰 Homeowners Are Struggling

-

Rising mortgage rates are pushing families toward forced sales and financial ruin.

-

Selling a home under negative equity often means walking away with nothing.

-

Banks and real estate profiteers don’t care—they profit from the system staying broken.

📉 Investors Are Locked Out

-

Real estate requires huge upfront capital, shutting out ambitious or first-time investors.

-

Buying property alone carries high risk and long-term debt burdens.

-

Meanwhile, corporate investors scoop up assets and dominate the market. This is what life and living has come down to.

🚀 Tyche: The Alternative We All Need

Fractional homeownership lets struggling homeowners retain their property by selling a quarterly investment stake.

Investors gain affordable, lower-risk entry into real estate and access to a valuable investment commodity.

Foreclosures decrease, financial relief increases, and wealth-building becomes more democratic.

The system was designed to keep you out.

The Harsh Reality

The cost of survival is skyrocketing, and for millions, there is no way out. The dream of financial security—owning a home, building wealth, having a future—HAS disintegrated.

💀 Home-ownership is a Fairytale.

-

The average wage hasn’t kept up with inflation in decades.

-

Mortgage repayments have doubled—while wages remain stagnant.

-

Even if you work two jobs, cut every cost, and save relentlessly, you’ll never catch up. - In-fact you are tax double for a second income...

📉 Debt, Foreclosures & Forced Sales Are Surging

-

Families are being forced to sell their homes at a loss, leaving them with nothing.

-

Elderly individuals, who should be enjoying the lives they’ve worked hard for, often face forced property sales and are funneled into retirement villages where their assets are tied up in trusts. As a result, they never truly own their equity or have control over their hard-earned wealth.

-

Negative equity means even after selling, they still owe money.

-

With interest rates climbing, millions will default. The banks already know it—they’re prepared to take everything.

⛓️ The System Was Never Built for Us to Win

-

Traditional real estate has always been a game of the rich.

-

Institutions, hedge funds, and corporate investors are buying everything up, pricing everyday people out of the market, forever.

-

If you can’t own property, you’ll be stuck renting for life—and you’ll never build equity.

-

This is the breaking point. If we don’t create a new way forward, the middle class will be wiped out completely.

Tyche - Could be a world wide pivotal part of a solution.

HOW Tyche Could WORK?

The Anonymous Partnership & Third-Party Buy-In Model Application + System

Tyche is the concept, identity, operating system, and matchmaker app for real estate finance. It connects homeowners facing distress with low-income or everyday investors who aspire to own property but lack the full capacity to buy outright—creating fair, hopeful pathways to shared equity and prosperity.

At its core, Tyche operates on two powerful principles, inspired by the ancient Greek goddess of fortune, luck, and guiding prosperity: Anonymous Partnerships – Secure, Vetted Co-Ownership

You never need to meet your financial partner. Homeowners and investors are matched anonymously based on aligned financial goals and property criteria.

-

All legal and financial agreements are managed by trusted third-party partners, ensuring full compliance, security, and peace of mind.

-

Tyche verifies, vets, and protects every participant—building a safe, professional environment where fortune favors thoughtful connections. Third-Party Fractional Buy-In

-

Homeowners sell a portion of their property (e.g., 25%) to a vetted investor, unlocking instant financial relief while retaining their home and life.

-

Investors secure fractional ownership with lower entry costs, shared risks, and no day-to-day responsibilities—like landlord duties or tenant issues—focusing purely on long-term equity growth.

-

Built-in exit options keep things flexible: homeowners can repurchase shares over time at fair value, or investors can sell their stake later for potential profit.How It Works in 3 Simple Steps: Homeowners List Their Equity Anonymously – Decide how much of your property to share (e.g., 25%) and set your terms.

-

Investors Buy In Securely – Matched partners purchase the fraction, creating a low-barrier entry into real estate with high potential.

-

Third-Party Partners Handle Everything – Tyche oversees ironclad agreements, secure transactions, fair valuations, and ongoing protections for all.

-

No risky new mortgages. No forced sales. No outdated one-size-fits-all rules. Just smart, strategic, and humane property partnerships that align goals, unlock fortune, and share the wealth.

STATISTICS & RESEARCH

The Reality – The Numbers Don’t Lie

The housing market is in crisis, and the data proves it. Wages are stagnant and haven't moved inline with inflation and costs, mortgage rates are climbing, and home-ownership is slipping out of reach for millions. This is a world wide problem.

Here’s the truth: 2025

📉 Mortgage Stress is at an All-Time High

-

In Australia, over 1.5 million households are experiencing mortgage stress—unable to afford basic living costs after making repayments.

-

Variable mortgage rates have more than doubled in two years, crushing homeowners.

🏠 Homeownership is Becoming a Luxury

-

The average house price in Australia is over $700,000, while the average wage is only $80,000 per year.

-

In the USA, UK, and New Zealand, home prices have tripled in the last two decades, far outpacing wage growth.

💰 Investors Are Locked Out

-

The cost of entry into real estate is at an all-time high, shutting out everyday investors.

-

Traditional mortgages mean massive debt, high-risk interest rates, and decades-long repayment commitments.

🔥 The Market is Failing— Disruption Is Needed.

-

By fractionalizing homeownership, Tyche. allows investors to buy in with lower capital and homeowners to regain financial stability without selling their homes outright.

-

This is real estate for the real world—built for today’s economy, not yesterday’s rules.

📩 Want to see the full data? Download the detailed report below.

Australian Property Market Update – 2024/2025 Outlook

Rate Cuts in 2025? No Guarantees Yet

Talk has already started about possible rate cuts in 2025, but there’s no guarantee this will occur, as the Reserve Bank of Australia remains cautious.

Key Market Updates

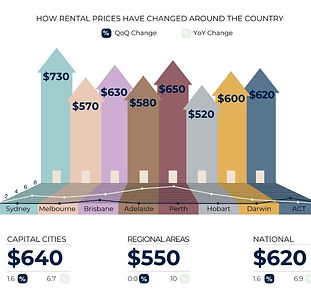

📈 Rents Hit Record-High Despite Market Slowdown

📌 First Home Buyer Grants – What’s Available

💰 Five Signs It’s Time to Refinance

🏡 Market Predicted to Favour Buyers in 2025

The Rental Market – A Mixed Outlook

Recent rental data presents conflicting news for both investors and tenants:

-

The national median rent hit a record-high of $620 per week at the end of 2024 (PropTrack).

-

However, rental growth is slowing, with just 1.6% growth in the December quarter—the lowest rate since 2021.

🔹 For Tenants: The rental slowdown reduces financial pressure, which is helpful if you’re saving for a home deposit. However, the market still favours landlords.

🔹 For Investors: While rents are likely to keep increasing, growth will be much slower than in the past three years. Be realistic at your next rental review and seek guidance from your property manager to understand local market demand.

First Home Buyer Assistance – What’s Available?

Getting on the property ladder is challenging, but government incentives may make it easier than you think.

Federal Government Schemes:

✅ First Home Guarantee & Regional First Home Buyer Guarantee – Allows eligible first-time buyers to purchase with just a 5% deposit, without needing to pay Lender’s Mortgage Insurance (LMI).

✅ Help to Buy (Coming Soon in 2024/25) – A shared-equity scheme that allows buyers to reduce upfront costs to as little as 60% of the purchase price, with the government owning up to 40% of the property.

Please,Use this Concept.

Network, Build and Create Change

- I Thank you for your time!

Network Partners - Ad Space